Charging customers who purchase qualified residential charging equipment between january 1 2018 and december 31 2020 may receive a tax credit of up to 1 000.

Electric car tax credit 2018 california.

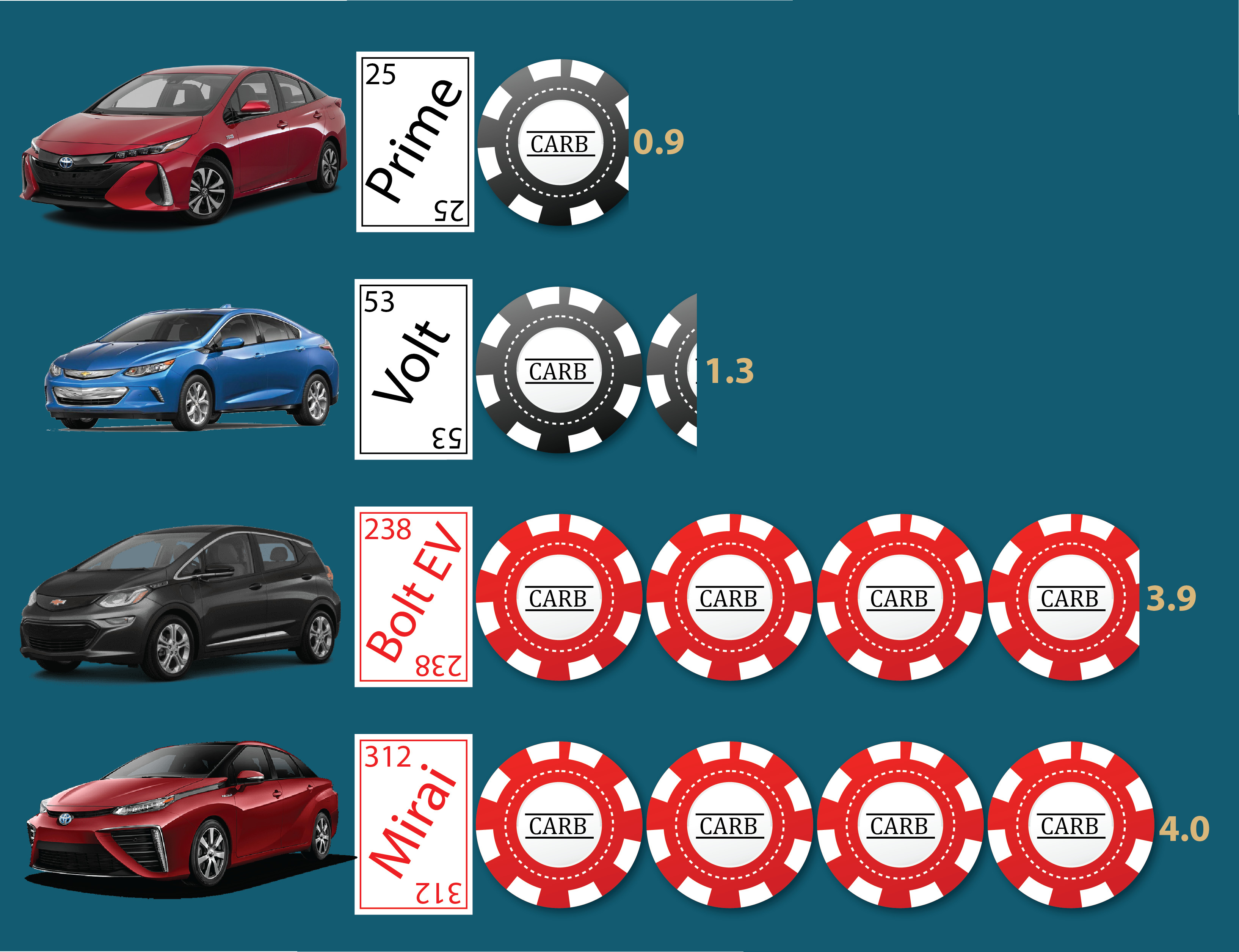

The federal government provides a substantial tax credit for new battery electric and plug in hybrid evs ranging from 2 500 7 500 depending on the capacity of the ev s battery.

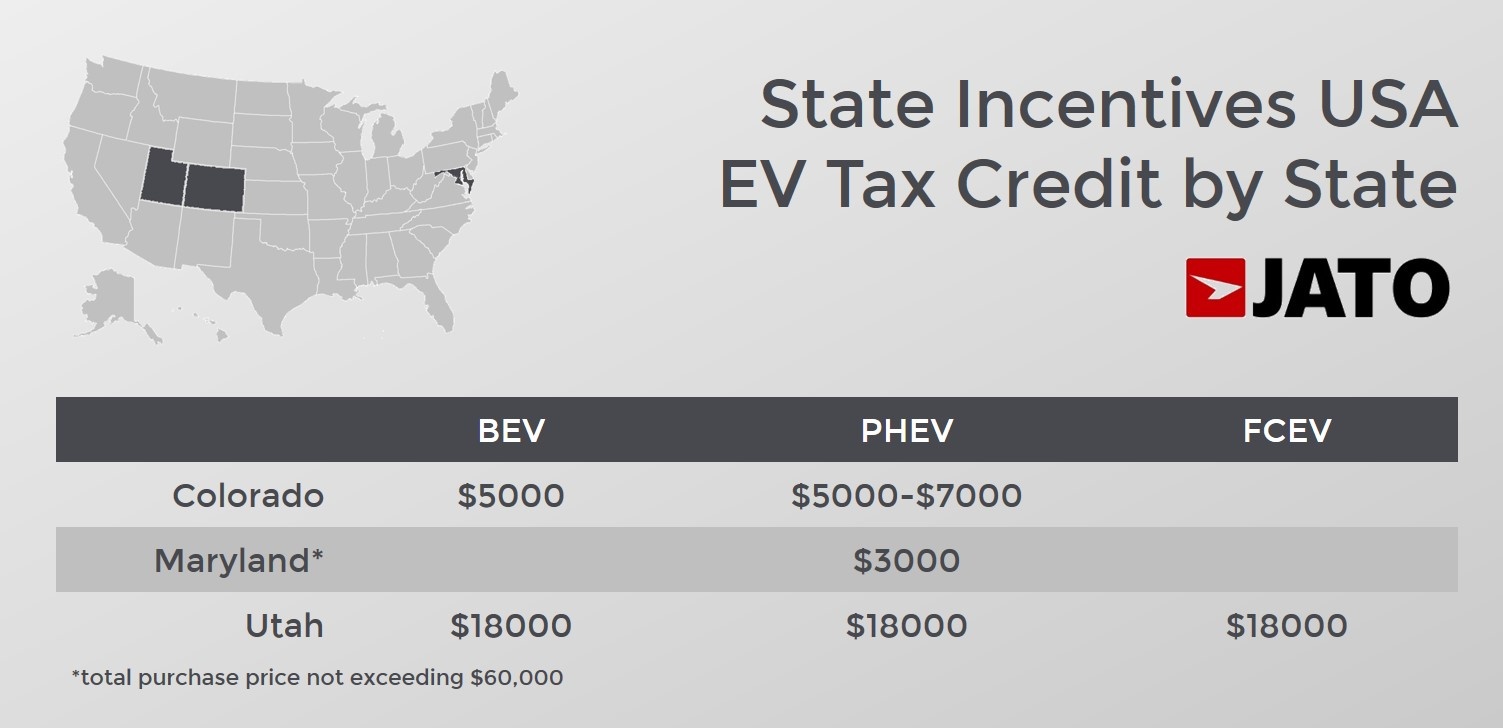

If you have state ev tax credits available you ll hope the number is higher.

Several states and local utilities offer additional electric vehicle and solar incentives for customers often taking the form of a rebate.

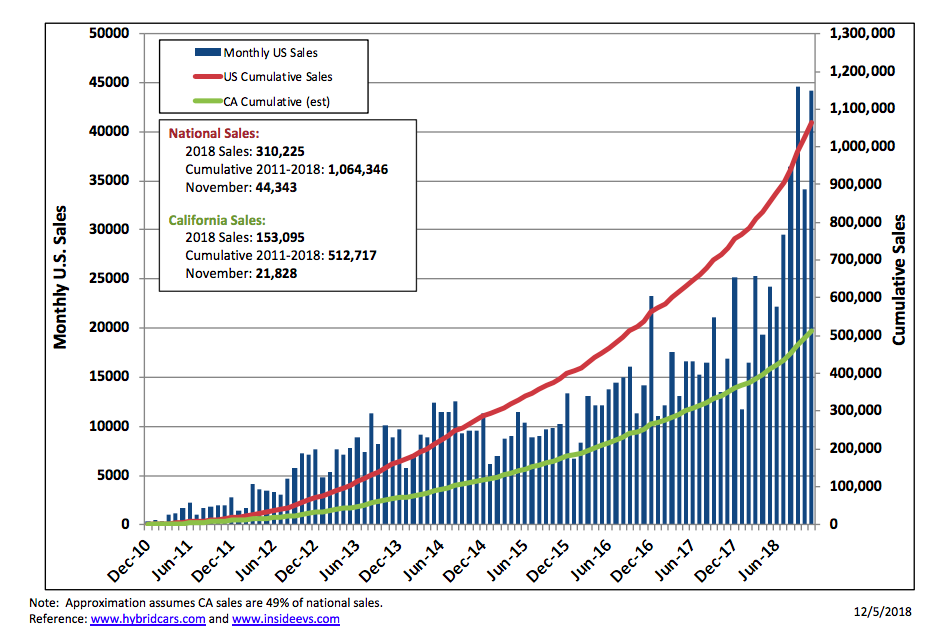

So far california based tesla and general motors are the only u s.

The exact amount of tax credit that you qualify for will depend on the type of electric car that you are driving.

At least 50 of the qualified vehicle s miles must be driven in the state and the credit expires at the end of 2020.

Get up to 7 000 to purchase or lease a new plug in hybrid electric vehicle phev battery electric vehicle bev or a fuel cell electric vehicle fcev.

However dealerships often factor it into the lease lowering the down payment or monthly.

Administered by cse for the california air resources board the clean vehicle rebate project cvrp offers up to 7 000 in electric vehicle rebates for the purchase or lease of new eligible zero emissions and plug in hybrid light duty vehicles.

Notice 2013 67 qualified 2 or 3 wheeled plug in electric vehicle credit under section 30d g.

Hopefully that number exceeds 7 500 for the tax year.

About publication 463 travel entertainment gift and car expenses.

All form 8936 revisions.

Whether you live in california or anywhere else in the united states the federal government will give electric car owners a tax credit of up to 7 500.

All battery electric vehicles are eligible for the full 7 500 whereas some plug in hybrids with smaller batteries receive a reduced amount.

Tax credits for heavy duty electric vehicles with 25 000 in credit available in 2017 20 000 in 2018 18 000 in 2019 and 15 000 in 2020.

Notice 2016 15 updating of address for qualified vehicle submissions.

If you lease the credit goes to the manufacturer.

After that part iii assuming the car was not a business investment you ll go through the process of subtracting the credit from your taxes owed on form 1040 line 47.

Claiming state rebates and credits.

Auto manufacturers of battery electric vehicles to reach that 200 000 unit sales milestone since federal tax credits became available in 2010 as part of the american recovery and reinvestment act a federal program that supports alternative fuels and advanced vehicle technology.